SKEW, FED, VOL OF VOL SUPPLY

We have some war premium unwind during the overnight session on the cease fire news. However, Friday 22 delta fixed strike skew went up by 1.91% since yesterday close and by 4.49% since last Friday, and down into EOM by -1.61%; this reinforces the weekend post’s dynamics, and note also, that July OpEx skew went up by 1.35% since yesterday.

The 5 delta put skews show only 0.51% increase into Friday expo, 0.01% into EOM and 2.56% into July OpEx since yesterday. VIX also didn’t changed too much, only decimals, a bit steeper.

Fed funds futures also went up only by 9.22% but actually down by -5.15% on a monthly basis (avg moves here). Fed faces a lose-lose stagflation dilemma. Which one would be the better evil. Any path—cutting or holding rates—risks long-term damage to the Fed’s credibility and independence. Cutting rates under political duress may produce short-term gains yet compromise the Fed’s apolitical mandate, while holding steady could invite harsher political attacks if growth slows.

The broader FOMC—including the voting regional presidents—remains cautious, implying the Fed may delay action until clearer data emerge on inflation and growth. Many policymakers refuse to cut rates until the uncertainties around tariffs and their impact on inflation, growth, and jobs are resolved, so my guess is that the Fed will await more clarity on trade-policy effects before easing.

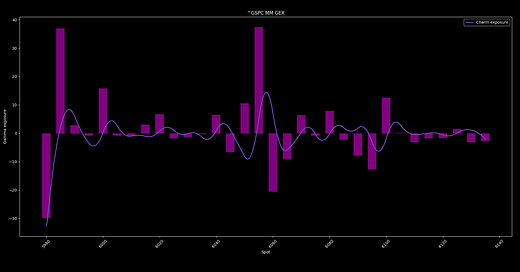

Market doesn’t fear left-tail event, that I’m keep emphatizing. During the next month market is supported by vol of vol supply, until oil-crisis happenes. August - Sept window will be taugh.

The supportive effect comes from the short vanna flow and net vol grind-up, as I keep explaining. Short vanna = vol up/delta down, forcing dealers to buy deltas. If vol would be sold, that would also cap any downside grind, bcs of the downside vega and gamma supply. On this week, the mechanical flows point towards mechanical vol selling, that would provide pressure on the spot.

During the overnight, fix strike skew and RV actually went up, on this squeeze.

Tbh, for me the conflict doesn’t seem finished

And reversion model shows 81.65% probability for a reversion, that I would interpret as profit taking and vol selling (both mechanical due to long vomma, and speculative). But as you can see in the skew, nothing actually changed.

The only thing, that short-term changed is macro focus. But this is also temporal. The underlying focus is still on growth-concerns, and SPX/yields beta showed “bad news are bad news” regime. But now, it is artificially changed through Bessent put, and Fed speakers rhetoric, to spread dovish hint, shifting the regime into “bad news are good news”. This prevents any left-tail events, a preemptive move, nothing more. Only temporal.

This caps GOLD, Oil and volatility. basically a metaphorical “vol of vol supply”.

The thing is, that this regime still doesn’t favor for upside liquidity build-up.

Don’t be lost in the noise… take this trading advice posted here: