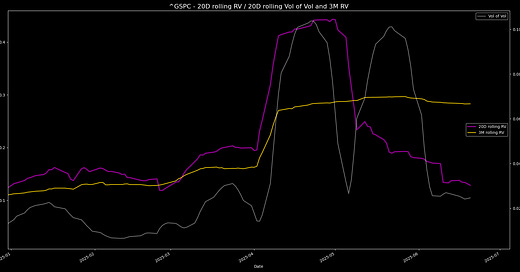

The volatility landscape didn’t changed significantly since last Sunday.

Volatility flows, Sentiment read and OpEx - Weekly post (16-20/June)

Last week, we had a sentiment shift towards growth concerns, inevitably suppressive vol selling feedback loop that ended up in a red 80%+ reversion signal to own the market on the short side. But spot closed above the sentiment-flip level.

You can see how vol of vol realized to the downside, along with realized volatility, with a weekly spot down/vol down move that is a typical short vanna behavior, as I kept explaining it publicly too.

And term structure also keeps developping as expected:

The setup favors for a natural grind up in volatility into August, until the positions expire, and market collapses when tariff effects hit the economy and the vol market… Bessent’s machniations are not that succesful yet.

What causes this, is the dealer short veta effect that naturally builds a floor for the vol suppressing moves, making it shape higher lows. While long vomma makes sure to dampen any spikes in volatility. This also causes short zomma in the index, meaning, that as vol grinds slowly higher, gamma decreases giving more room for vol to grow. These are mechanical effects.

The short vanna position in the index, swallows every downside vol, also coming hand-in-hand with short speed (longer downside gamma). But gamma effects are more significant in the front-end tenors, and mostly locally.

Another important layer is that the growing vol expands the range of the short vanna and flattens its curve, decreasing its impact. So while the flip points slide farther, the vol effect on deltas decreases and the moves can slowly accelerate as local gammas will also be eaten up by the zomma. But here, the local, daily positions, sharp short speed exposures, etc. can manage the downside vol.

Why it is happening? 1) Bessent put, 2) geo risk.

Market is all about the illusion of growth now, but we know since April that we are in a bear market…

Let’s look at the weekly positioning, and the levels that actually have meaning within the noise…