Intraday vol breakdown + Intraday post (14/May)

Speed profile with intraday vol breakdown

Weekly post is here.

CPI preview and review is posted here below the paywall.

After tariff relief, many strategists cut recession odds and turned bullish, forecasting only modest corrections, a broad consensus of a ~10 % rebound by end-2025, warning investors “don’t buy the hype” of deeper sell-offs.

However, lingering risks in trade-war dynamics is still there, despite the rally, meaning that any failure to extend or honor the pause, and if the Fed mishandles rate-cut expectations, can trigger sharp, even bigger reversal.

QT regime along with maturing balance‐sheet roll‐offs pull liquidity out, there’s far less dry powder to absorb shocks. Also note, that we’re hitting the five‐year milestone of debt and equity refinancings, and the resulting cash‐scarcity is a major hidden vulnerability.

You have to understand that structural forces fundamentally determine the distribution and risk premia. This is why it is important to assign a narrative to this current short vol-driven relief-rally.

Stagflation is masked now, sentiment-wise. Market misprices the current state, and the risk of the looming bear market.

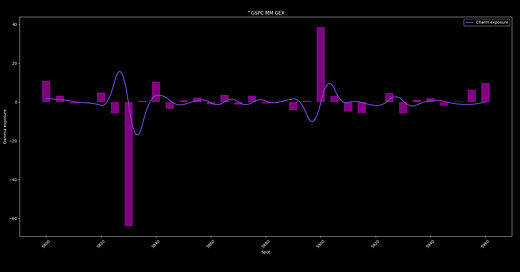

As you already know, I expect May OpEx to be supportive, especially now as SPX is trading above the key levels while volatility is keep grinding lower.

I see the OpEx as the possible peak. Heavy reliance on T-bills means rollover risk is rising, putting upward pressure on yields and downward on asset prices if new buyers don’t step up.

But I will wait for the signal of the model to go above 80% probability. No rush to short.