FOMC preview, Trading advises + Intraday post (17/June)

FOMC, Hormuz, Retail Sales, Intraday post

Yesterday, my vanna model said 6050 as max if vol doesn’t calms down, giving us a 60 pts profit during the overnight.

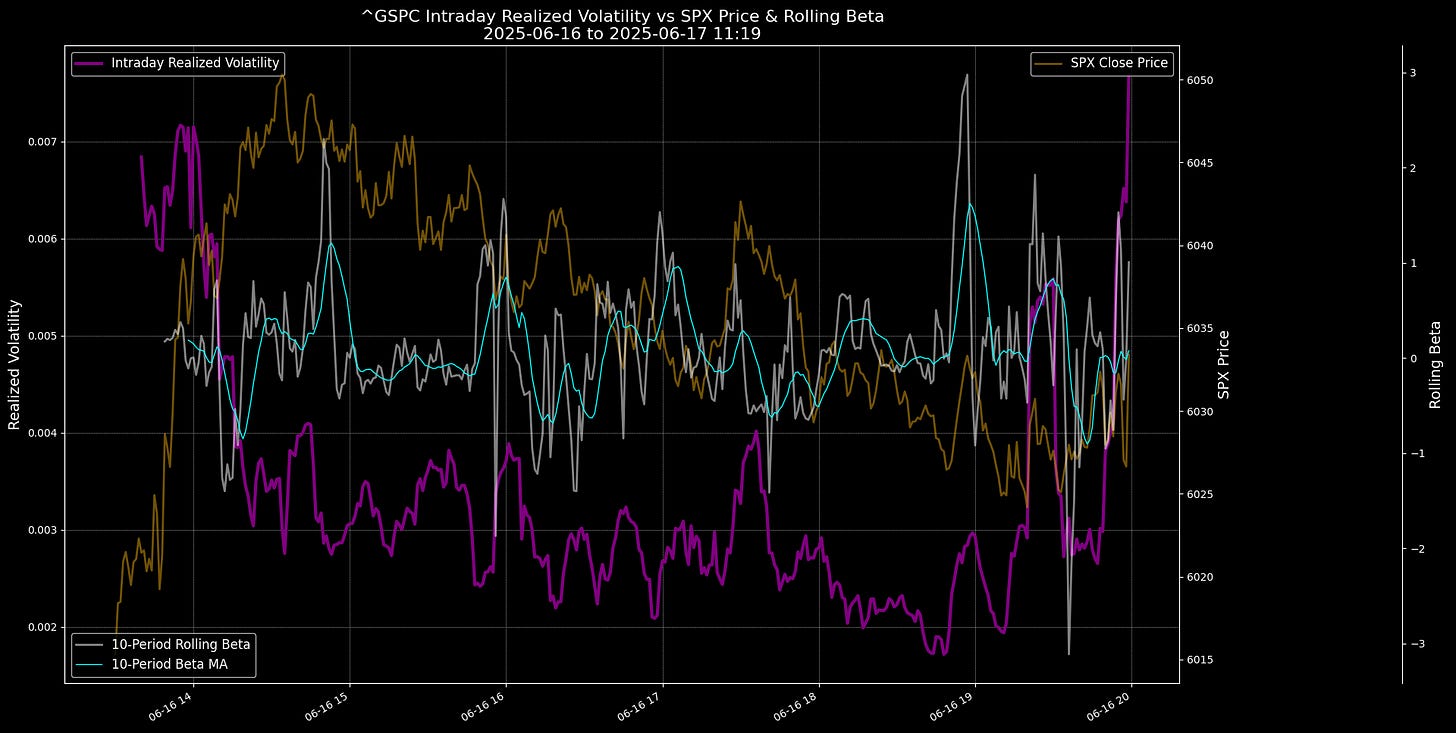

The intraday spot/vol beta yesterday was 0.095062 in avg, 0.043498 as median, and closed at 1.007296, a 478.034252% increase during the day.

Meanwhile vvol (white line) was realized to the downside, just right as the Sunday post predicted:

Hormuz is well-threatened, and we need to monitor closely if the skew goes longer or not, bcs that can reverse the vol profile. Until nothing unexpected happens, I think it is enough to reassume on the next Sunday, but let’s keep our eyes on that risk.

You find the descriptions in my Sunday post.

Before I jump into the short FOMC preview, I want to re-share my yesterday write-up of intraday trading. It is free for all subs:

Please, take your time to re-read it.

FOMC Preview

Federal Reserve plans to hold its policy rate steady—even though recent inflation readings have been benign—because policymakers remain highly attuned to inflation expectations and tariff- and geo‐related uncertainties that could reignite price pressures.

Midsummer tariffs create enough uncertainty that the Fed’s dot plot may shift hawkishly, delaying cuts into late 2025 or even into 2026.

The Fed’s caution reflects a desire to anchor expectations rather than risk repeating past mistakes of premature easing, noting that businesses and workers may act on even small upticks in expected inflation by raising prices and wage demands. University of Michigan’s show that consumer inflation expectations briefly rose after tariff announcements—even if they later moderated—highlighting the Fed’s concern that continued tariff uncertainty can become self-fulfilling.

Also, as said on Sunday, the Strait of Hormuz remains a potent inflation/stagflation risk, as even the threat of closure can add a $10–$15/bbl risk premium to oil prices—enough to lift headline inflation by 0.1–0.3 percent if sustained. (Note that a full blockade could send Brent to $120–$130). At the same time, the “midsummer” tariffs set to kick in around July 9 2025 (notably 50% on EU goods and expanded metals levies) are projected to pass through into core goods PCE, contributing 0.1–0.3 percent to inflation by year-end.

Market is still more concerned about growth than inflation, but mostly neutral. Literally less narrative now, in these uncertain times. The trend still points up, telling me, growth is the main narrative.

Trump is about to pump the economic performace to show result for his business partners in the Middle East. I still expect vol to be capped during this month and next month until tariffs hit in August.