This data is the last CPI before FOMC, and this is a pivotal data.

May’s NFP beat (+139 K vs. 130 K est., unemployment steady at 4.2%) signaled a still‐resilient labor market, though underlying revisions and participation dips imply mild cooling rather than a hard landing.

The April CPI reading of 2.3% y/y appears to have been the trough, and economists now forecast May’s headline CPI at 2.5% y/y with a 0.2% m/m increase; core CPI (ex-food and energy) is seen at 2.9% y/y and up 0.3% m/m. Also short-term inflation swaps have surged to about 3.07% over the next 12 months, reflecting the market’s view that current tariff-driven pressures will lift consumer prices further (~3%) and that Fed rate cuts won’t come until at least September.

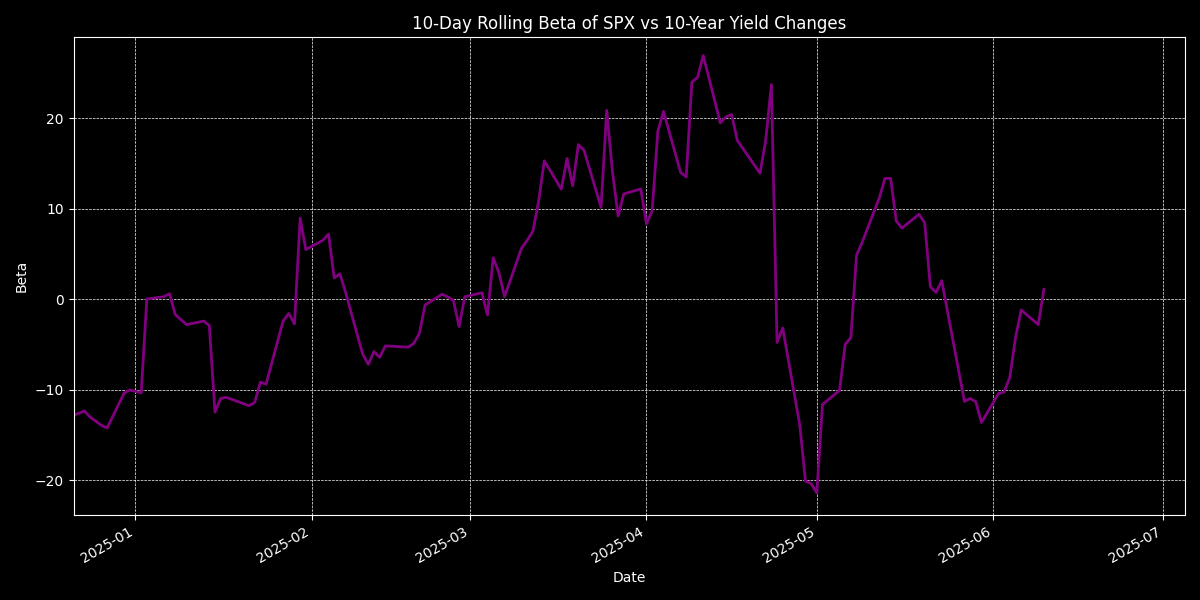

My suspicion came true with the SPX/LTY beta, it went neutral-to-positive ahead of CPI:

Prices paid indexes (PMI surveys) typically lead CPI by 6 months—rising since January, this suggests a June CPI uptick and stronger summer prints. Seems like +0.2% m/m, 2.5% y/y. But the thing is, market has no fear of inflation now. It is priced in.

Note, that the paradox of this situation is, that if CPI comes in line with expectations, traders will start to sell vol that is net suppressive for equities in the current environment.

The reversion model shows…