Introduction

By setting aggressive, high tariffs and then hinting at cuts only under specific deal conditions, Trump risks whipsawing industries—exporters, importers, and manufacturers. Credible policy frameworks need built-in flexibility; otherwise, they degrade trust. While tariffs can provide leverage, they must be part of a dynamic playbook—with clear, phased adjustments linked to verifiable benchmarks—rather than one-off spikes and indefinite hangs.

And this is important because U.S. efforts to reset ties with Russia are constrained by a robust Sino-Russian alliance—limiting his diplomatic options and complicating any peace or trade initiatives.

This poses a huge risk on Taiwan, as the display of unity between Beijing and Moscow accelerates the closing window for deterrence, sharpens the PLA’s doctrinal edge from Ukraine lessons, and intensifies Taiwan’s historical-narrative campaign. But more on this after the Victory-day… until Trump’s next moves—signals of support for Russia, pressure on Kyiv/EU, or mediating language—will either validate or derail Putin’s tentative overtures, defining U.S. influence in the final days before Victory Day. Xi is playing for Trump’s weaknesses, and he is playing well.

Keep your eyes open and watch the dates and the events I marked…

After NFP…

April’s jobs report—showing 177,000 payroll gains (well above the 138,000 median forecast) with no meaningful uptick in unemployment—provides the Federal Reserve with little justification to shift from its “wait-and-see” approach to cutting interest rates at the June meeting.

Fed officials have signaled rate cuts will require clear signs of rising unemployment, not just moderating job gains. Given April’s unexpected strength, the Fed is likely to hold rates steady at 4.25 – 4.50 percent on May 6–7, offering little if any new dovish guidance about June cuts. However it also raises the bar for any future easing—meaning that real rate cuts may be pushed well into 2026 unless tariff shocks trigger a sharper slowdown in the coming months.

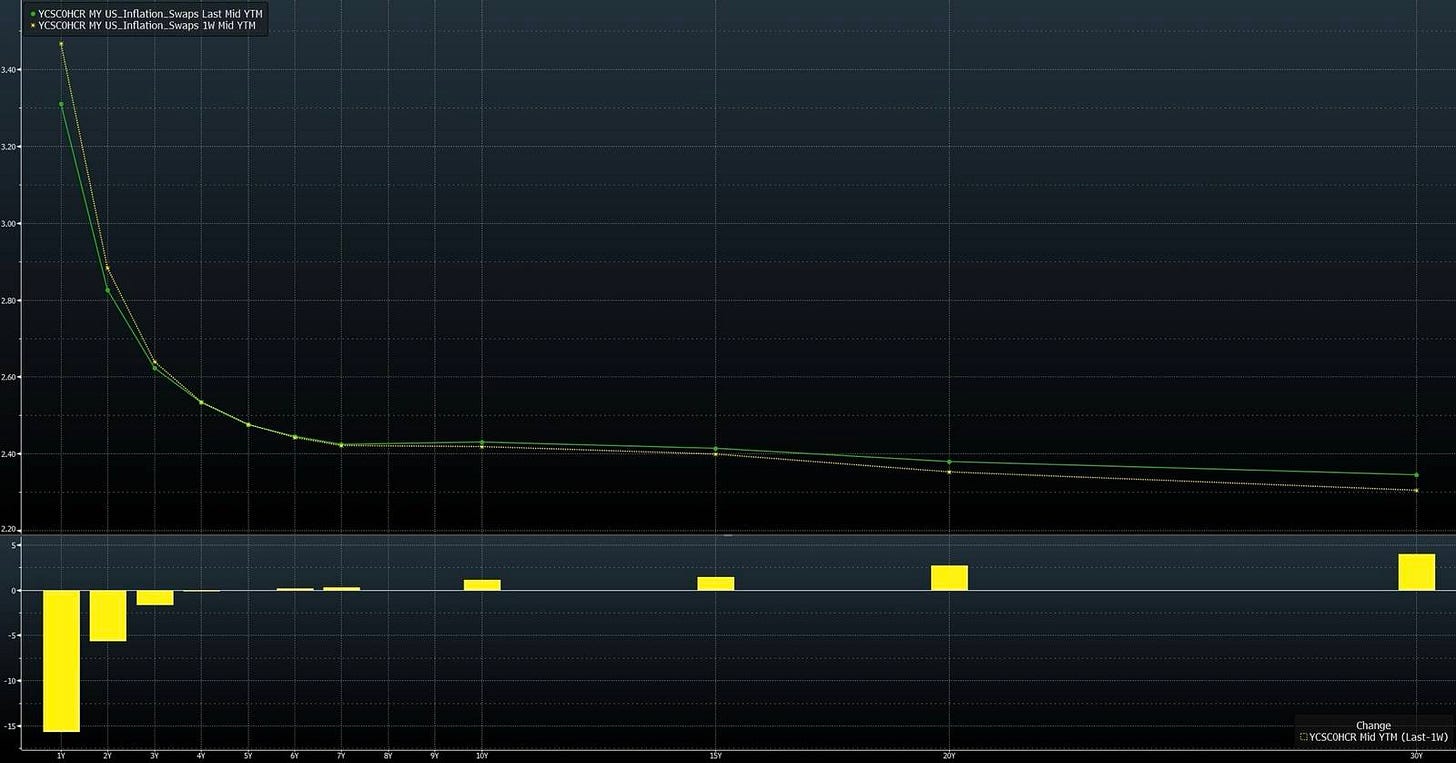

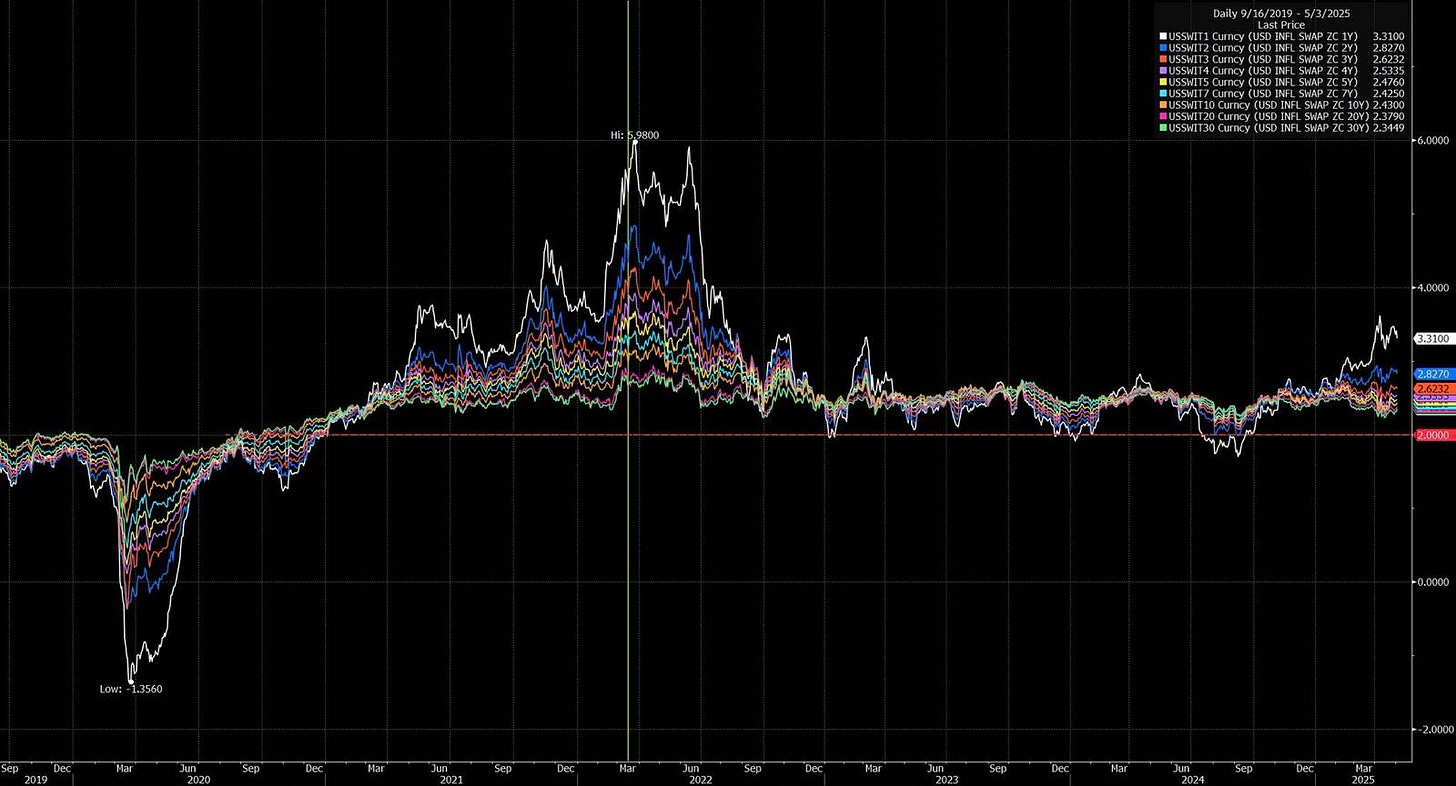

They see the coming stagflation risk.

By early May, the index had regained all of those losses, trading back above its April 2 close—an impressive rebound driven by tariff-pause hopes, strong earnings and solid jobs data. The index finished 2.92 percent higher for the week ended May 2 and 7.65 percent higher over the last two weeks—the largest two-week gain since October 2022. However, don’t fall for the mechanical and artificial squeeze we are experiencing…

The 10-year Treasury yield has risen 0.146 percentage points to 4.317 percent, pushing it above its level on April 2, reflecting market conviction that the Fed will maintain restrictive rates for longer, given strong jobs data and delayed tariff effects. With the front-end of the curve essentially parked at Fed funds levels and the back-end rising, yield-curve flattening persists—an indicator of policy tightness and slower long-run growth expectations.

The strong April jobs data temporarily alleviated recession fears, but ongoing uncertainty about Trump’s “stop-start” tariff rollout, the coming stagflation, coupled with geopolitical tensions will keep volatility elevated. This is a bear market rally.

I said that if the VIX falls below a certain level, the short squeeze and the artificial, algo-driven buying flow (based on sentiment manipulation via headlines) would get a vanna tailwind. That’s what we’re experiencing right now. It will end when the government runs out of good headlines and has to face a reality check.

The market is technical and policy-flow driven. Deep bearish puts won’t pay because tariff-driven growth headwinds and supply-shock inflation only intensify in mid-summer, per your earlier freight-delay timeline. Distress-trade payoffs are most likely around the July–August tariff cliff, not now.

Ahead of FOMC and heavy data, SPX is expected to range bound in the 5566.89 - 5754.47 range with key line to hold on Monday is 5627, then on Fed day giving some volatile intraday but closing within the prior session’s high–low band.

May OpEx also looks supportive for now, but will update on OpEx week.

I maintain short vol strategy as my main trade since Apr 13 and Apr 17, not betting too much on deltas… This also implies that more vol down = more squeeze to hold the market.

Now let me tell you something very important about this range and the actual levels…